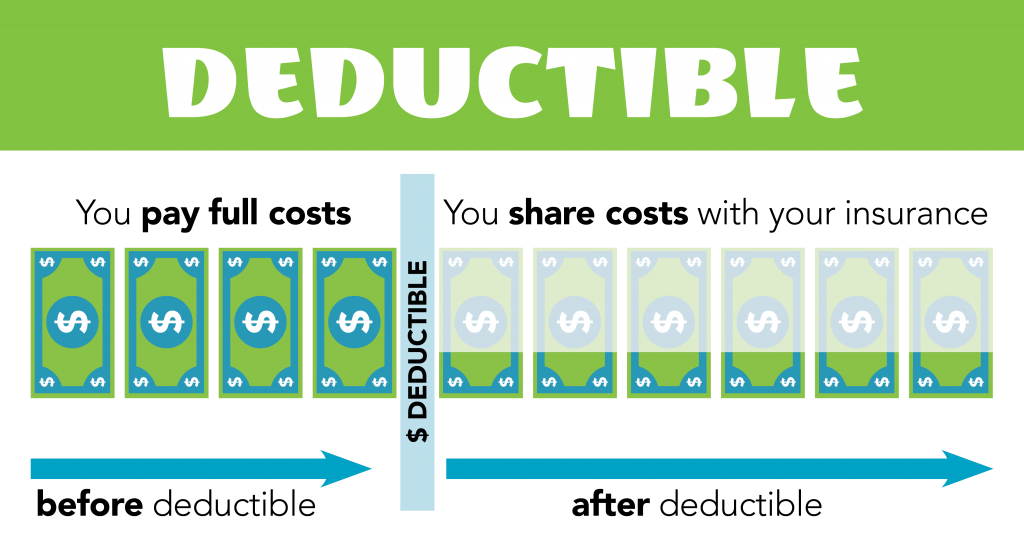

As an example, you might check out decreasing your thorough deductible considering that it represents a smaller section of the overall costs. That implies you will not save much cash if you boost this deductible. Although your insurance deductible does not reset yearly, you would still need to pay an insurance deductible every time you make a case. Some insurance providers will certainly reduce your insurance deductible for every year you do not have a mishap. cheap insurance. What you could not see is that these "savings"are blowing up the price of your costs. If it only takes a few months or a year, you can set apart sufficient to pay your premium, and after that start banking the rest. Paying an insurance deductible can mean needing to cough up a hefty

piece of modification. If you're stressed that you can't afford ahead up with enough money to pay your insurance deductible, you have a few options. When you're attempting to figure out just how much your deductible must be for automobile insurance, ask your insurer regarding what their procedure is for collecting deductibles, and also just how long it could take for you to obtain a payment. Below's what you can usually anticipate in a couple of different scenarios. Your insurance firm should accept the insurance claim in order for you to obtain a payment. When the amount of your damages reaches your insurance deductible, the insurance company will release a payment for any kind of fixing expenses beyond that amount When you enter into an accident with one more vehicle, the insurance coverage firms included will perform an investigation into which motorist was at mistake to establish that pays the auto insurance deductible. You may have questioned in the past, just how do insurance deductibles function? What are the different types of deductibles, as well as does the quantity affect the regular monthly settlements? In easy terms, a deductible is the amount of cash you dedicate to.

pay out of pocket prior to your insurance business begins to pay you any type of advantages. For instance: Say you have a deductible of $500 as well as you rear end somebody. If you are the at-fault vehicle driver, the protection will have to come from your crash plan. If your problems are$2000, you will certainly have to pay. dui.

the $500 deductible as well as after that your insurance policy will certainly pay the continuing to be $1500 (trucks). You would pay the complete$400 and also your insurance policy would not pay anything, because you did not reach the deductible. Different kinds of deductibles: A deductible can be a set amount or a percentage of the complete expense of your.

cheap insurance dui insurance auto insurance

cheap insurance dui insurance auto insurance

insurance claim. The example above uses a fixed insurance deductible. This number is something you will certainly agree upon with your insurer before you sign your plan. If you select a higher deductible your costs price will certainly be reduced. Simply bear in mind, if you pick a high insurance deductible, you require to have at least that much money conserved in instance you get involved in a crash as well as have to pay it. Where to locate your insurance deductible: If you currently have an insurance plan, you can find the quantity of your deductible on the primary web page of your plan, called the. It is near the front of your policy. Inspect to see what your insurance deductible is, as well as if you have any kind of problem discovering it or any type of various other concerns in all, call an Infinity agent at!. When it concerns automobile insurance coverage, your insurance deductible is one of one of the most vital parts

About Who Pays The Deductible In A Car Accident? - Anidjar & Levine

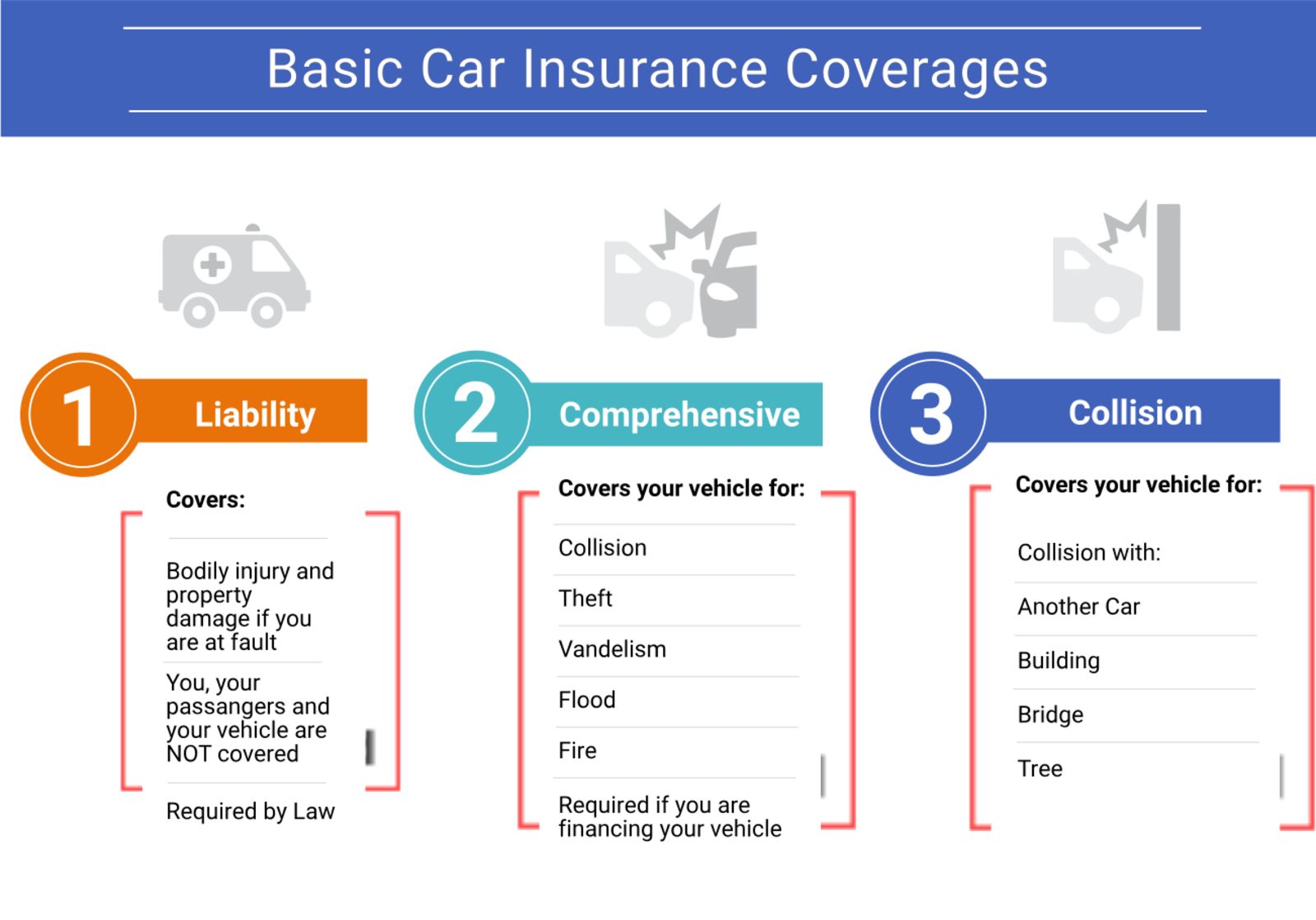

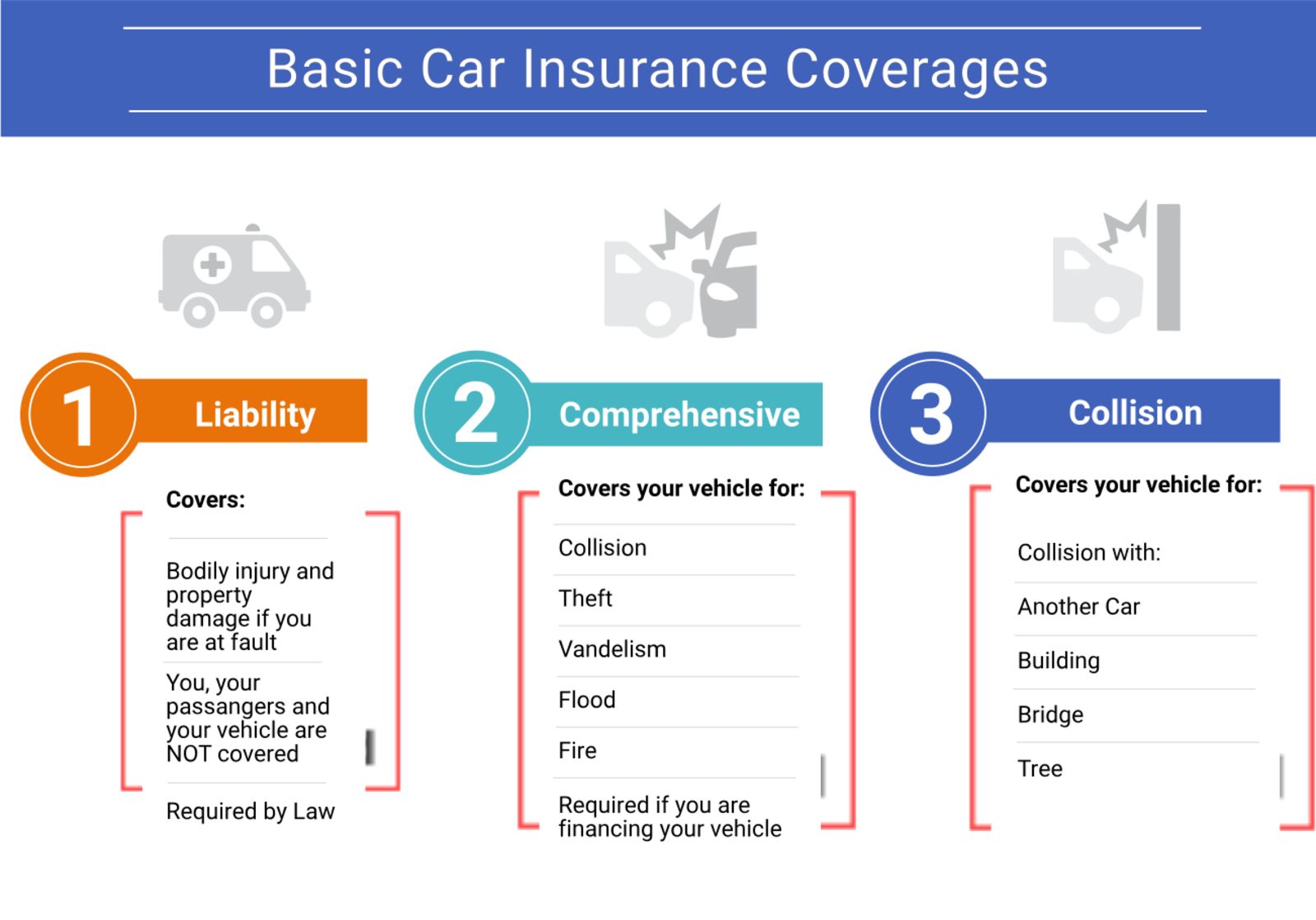

of your plan. As well as, guess what? You have control over it. A deductible is a quantity you need to pay out-of-pocket before your insurance policy coverage kicks inand it can be various for every person. So, exactly how do you recognize what the ideal insurance deductible is for you? In this article, we'll assist you recognize what deductibles are, just how they function, and also what to consider when selecting your vehicle insurance coverage deductible. Allow's break down the different sorts of deductibles and what they may mean for you. No, obligation insurance does not require an insurance deductible. Liability coverage is caused when you've been identified responsible in an.

mishap where a person is harmed and/or their home is damaged. In this scenario, your obligation insurance coverage will cover the expense sustained by the hurt person, and also there is no deductible required. Deductible amounts will certainly differ from one insurance policy carrier to the following, but common deductibles are $250,$500, & $1,000. So, when should you file a collision coverage case? You can submit a crash insurance coverage case whenever you struck another car, building , utility post, or things. When you're in a covered crash case, your crash insurance coverage will certainly assist spend for the expense of repairs. However, when one more driver is at-fault and also strikes your automobile, things will certainly look a little various. In many cases, you will certainly not need to pay any type of deductible when one more driver strikes you. As long as the at-fault driver lugs adequate insurance coverage, their obligation protection must cover the price of your repair services. Your UMPD insurance coverage would certainly assist spend for the damages to your lorry. Lots of states call for motorist's carry some type of UIM insurance coverage, while others require insurance companies to supply UIM protection and chauffeurs can select to reject it. Uninsured Motorist Bodily Injury, If you're included in an injury accident where the at-fault driver does not lug sufficient insurance policy, your Without insurance Vehicle Driver Physical Injury(UMBI)protection can help cover your clinical therapies, discomfort and suffering, lost earnings, and also funeral costs( in the unfortunate occasion of a death). Whether or not this protection calls for a deductible can vary depending on the state. suvs. If your insurance deductible is more than the price of repair services to your vehicle, you will certainly be in charge of covering the whole expense yourself. insurance affordable. For instance, if your deductible is$500 and also it sets you back$300 to deal with a broken taillight after you backed Click here! into a fencepost, you would be accountable for paying the$ 300 in repairs expense. Some parts of a vehicle insurance plan are required, some are optional, as well as others have variable elements, like the certain protection quantity or the deductible you pick. These coverage alternatives as well as various other score aspects will certainly establish the costs you pay for your car insurance policy coverage. The deductibles you choose can have a signicant influence on your insurance coverage prices, so when you are deciding which deductible to select, it is very important to consider the strategy that will work best for your unique needs. Selecting a reduced deductible ways you pay less money when something occurs to your auto, yet your regular monthly settlements will commonly be higher. While you'll always wish to consider your individual circumstance as well as preferences, people that pick greater deductibles commonly value a reduced monthly premium may prefer to take care of tiny insurance claims on their very own or may have a lower-valued vehicle that they would instead change in case of an accident. To select the best deductible for you, below are a few points that will be handy to take into consideration: If you were to choose a$ 1,000 deductible, would it be testing to come up with the funds in case of a crash? Everyone is different. Some people like to deal with minor repair work by themselves and only count on their insurance coverage in more pricey scenarios, while others are a lot more inclined to sue no matter the size. Or, they might decline these protections entirely if it does not make financial feeling when thinking about the worth of their car. When submitting a vehicle insurance case, there will be certain situations that will certainly need you to pay a deductible and others that won't. Allow's look at a couple of scenarios(a non-exhaustive listing, obviously)where you 'd likely require to pay a deductible: When filing a crash claim after a single-car collision; When submitting a collision case after you are at mistake in a multi-car collision; When submitting an extensive case after an event besides crashes, such as burglary, fire, or hailstorm; When you're faced with an unforeseen and unpleasant event, not having to pay a deductible can seem like a huge alleviation.

car insured liability cheapest cheapest car

car insured liability cheapest cheapest car

Take control of your insurance coverage and also see what you can save by switching to Clearcover (whenever, all online). affordable.

Deductibles could be a standard part of auto insurance plan, but that doesn't indicate everyone recognizes exactly how they function. As a matter of fact, several chauffeurs aren't knowledgeable about how your deductible amount impacts just how much you spend for car insurance coverage. If you desire the most affordable automobile insurance policy, selecting a greater insurance deductible is one way to keep your monthly insurance payments low as well as remain covered, yet it's not the most effective alternative for every single motorist - automobile.

Keep scrolling to discover how auto insurance coverage deductibles work and exactly how to choose the best deductible quantity for you, plus how adjusting your insurance deductible could help you reduce your regular monthly auto insurance coverage payment. What is an automobile insurance policy deductible? A deductible is a collection amount of money that you must pay ahead of time and expense when submitting a protected claim before your insurance coverage starts to help cover the remainder of the damages. perks.

Some Ideas on What Does Deductible Mean In Car Insurance? You Should Know

Rate might differ based on exactly how you acquire. Not all products, discount rates, or pay plans are offered in all states.

>> Lorien: Hey guys, I'm Lorien. I'm a customer service hero, as well as an insurance representative, as well as it's quite fun. >> Lorien: I'm right here to speak to you concerning deductibles, and what they imply for you for your house plan and your automobile plan.

suvs cheaper cars low cost insurance

suvs cheaper cars low cost insurance

>> Lorien: Let's just claim you have a case that sets you back 10 thousand dollars and your insurance deductible's a thousand dollars. You're going to pay that thousand dollars and your insurance provider is going to pay the staying 9 thousand. >> Lorien: If we didn't have deductibles there would certainly be a number of small cases which makes your premium increase.

Whereas if you have a lower deductible, after that your premium is going to be greater, it's like switch one for the various other kind of thing. cheaper car. >> Lorien: It's really approximately you and your degree of monetary comfort, just how much you're going to be able to pay out of pocket should something happen.

Take control of your protection as well as see what you can conserve by switching over to Clearcover (whenever, all online).

The 6-Second Trick For How To Choose Your Car Insurance Deductible (2022 Guide)

Deductibles might be a typical part of cars and truck insurance coverage, but that does not imply everyone recognizes just how they function. As a matter of fact, many drivers aren't knowledgeable about how your insurance deductible amount influences exactly how much you pay for automobile insurance coverage. If you desire one of the most affordable automobile insurance coverage, picking a higher insurance deductible is one way to maintain your month-to-month insurance coverage payments reduced and remain covered, however it's not the very best choice for every chauffeur.

Maintain scrolling to discover exactly how auto insurance deductibles job as well as just how to choose the best insurance deductible quantity for you, plus how readjusting your insurance deductible might aid you decrease your month-to-month auto insurance repayment (vehicle). What is a vehicle insurance policy deductible? An insurance deductible is a set quantity of cash that you have to pay ahead of time and also expense when filing a covered insurance claim prior to your insurance begins to assist cover the remainder of the damages - insured car.

suvs money vehicle insurance liability

suvs money vehicle insurance liability

For additional information about car insurance deductibles or a free quote on cost effective coverage, phone call 1-877-GO-DIRECT (1-877-463-4732) or quit by a Straight place near you!.?.!! * Repayment strategies go through terms and may not be available in all locations (affordable auto insurance). Price may differ based on how you acquire. Not all products, discounts, or pay strategies are readily available in all states.

>> Lorien: Hey individuals, I'm Lorien. I'm a consumer solution hero, as well as an insurance agent, and it's rather enjoyable. insurers. >> Lorien: I'm right here to chat to you about deductibles, and what they indicate for you for your residence plan and your automobile plan.

>> Lorien: Let's simply claim you have a claim that sets you back 10 thousand dollars and your deductible's a thousand bucks. You're mosting likely to pay that thousand dollars as well as your insurance provider is going to pay the staying 9 thousand. >> Lorien: If we really did not have deductibles there would be a bunch of little insurance claims which makes your premium increase.

The Greatest Guide To Car Insurance Deductibles Explained - Progressive

Whereas if you have a lower insurance deductible, then your costs is going to be greater, it's like switch one for the various other example (laws). >> Lorien: It's truly up to you as well as your level of financial convenience, how much you're mosting likely to be able to pay of pocket must something occur - cheap insurance.